6 February 2011 Barron’s Review, The Week Ahead and a Pick

BAGAKOAA;

6 February 2011 Barron’s Review, The Week Ahead and a Pick

Last week the S & P 500 finished up again. A strong 2.71%. Let’s see what Barron’s has to say about the gain and how sustainable it might be. This weeks issue seems to be very positive while still noting the chance for a correction is very real. There was a little sidebar by Gene Epstein explaining away the lackluster jobs report on Friday. While the number improved, it was way off analysts expectations. The market took it in stride as most other economic data was good. All in all, we called most of the data points spot on last week. We suggested the jobs would be almost flat and they kinda were.

Barron’s had some nice things to say about IDCC InterDigital, Inc. engages in the design and development of digital wireless technologies for use in cellular and wireless IEEE 802 related products. IBD has it rated a 99 and we will be doing more homework on it this week. Once that is done it has the making of a pick of the day. They were also pimping Corning GLW which we mentioned here a few weeks ago. The reason they like it, is their new Monster Glass which is being adopted in all kids of products. IBD likes them as well giving them a 92 rating. What caught my eye was the huge institutional buying in the last week. DO YOUR HOMEWORK. We do not own ether stock, but have them on our watch list.

Leslie Norton did a great job of connecting the dots between Tunisia, Egypt and Asian countries and what to look out for. This was an interesting read. Santoli’s article “Ready For A Breather” paints a rosy picture while reminding us a correction is lurking. (Just watch your stops and keep an eye on the market direction.) One of my friends asked when they should shift their Mutual funds to cash based. Unfortunately, but right for them they have been in balanced funds (bonds-Equities) for the last year and half. So they have seen some of the gain of the market but not all of it. I suggested they start to move now. Just change 10-20 of they funds to cash-bonds type funds and wait until they see the change a comin. My guess is this correction (again 2-25%) will come right about the time the Fed stops QE II which is March-April May.

The rest of the magazine mostly dealt with Mutual Funds ZZZZZZZZZ. I take that back seeing what mutual funds are buy can be an interesting tell as to where to look for stocks on the way up.

The week ahead.

Here are the data points for this week. (Remember this is important as it is a good engine behind the direction of the overall market and as we have discussed, 75% of your stocks direction is determined by the direction of the market and or sector.)

On Monday we have the consumer credit report coming out. You care about this as it is an indicator as to if people are spending. Since the economic crisis has occurred three years ago we have seen consumer credit drop and personal savings increase to a level not seen since WW II. We are seeing personal savings drop a little and if we can tie it with an increase in personal credit tomorrow, we might see some nice pops in the retail sector. Unfortunately the experts have pegged the increase of outstanding balance way up up from 1.4 Billion the month before. They are expecting 2.0 Billion. If weather kept people from finding jobs, don’t ya think maybe it kept them from charging crap on their credit cards? We are guessing a slight disappointment to 1.8Billion.

Tuesday we will see a couple of retail reports, but it will get snowed out as well.

Wednesday we will see the Energy Information Agency tell us how much oil is in the supply line. I am guessing strong demand so look for an implied up and coming demand pressure which should push oil prices higher. Good for us holder of CVX and other oil cans.

Also on Wednesday look for a kinder and gentler House Budget Committee to play a little nicer with Bernanke at his appearance before the group. That should not garner much attention unless the committee tells him how much money he is printing and scares everyone.

On Thursday there is wild card to watch and that would be the reporting of the Bank of England economic policy announcement. (Martin and Neil if you are listening, correct me if I am getting this wrong.) The policy is to chase a 2% inflation figure which they have not hit yet, but it does not take Nostradamus to see raw material costs and agricultural cost increases eventually impacting the inflationary picture in the UK. The BOE could send everyone a tap on the breaks by increasing their interest rates.25%. That could make for an exciting day in the market.

Also on Thursday we will have initial jobless claims. We find nothing to argue the consensus of 412,000 jobless applications. That news won’t help to hurt the market.

So how will the market end next week. The S & P 500 closed at 1,310.87 on Friday. It will close at 1,329 next Friday.

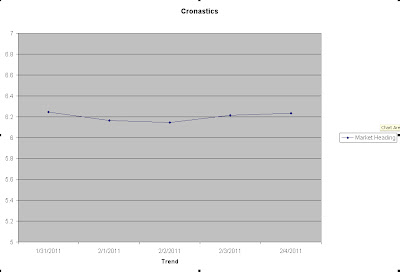

Earlier in the week we told you we were working on a tracking mechanism that might help us get a gauge of market trends. It is the combination of some IBD information as well as some data from the NYSE. It is the averaging of the last 10 days of momentum.

Once we have a few more data points under our belt, we will apply some magical mystical standard deviations to the chart to determine some upper and lower control limits to spot anomalies. Until then we will publish the chart every week. We will be looking for a number below 6.0 to indicate a downward trend not only in the beautiful chart, but the overall market. Then again, we might be just wasting ours and your time. We will see.

Pick of the Day AGAIN

Let’s take a serious look at SWKS again. Megan brought this to us last week. Our suggestion was to wait for a few more positive days above 30 and we go them. Friday’s volume was 4.6 million shares and the stock was up 3%. This is a good entry point at 35. DO YOUR HOME WORK. WE WILL OWN THIS TOMORROW. We may be long or get in on a 2 month slightly out of the money call option. Put your stops in at $32.25. If Megan took our suggestion to stop at $25.50, you might want to scoot them up a bit to the 32.25 level. If you do not want to use the stop another idea would be to buy a put option just out of the money 3-4 months out. It will accomplish the same thing. If you are not experience in options, just sell the equity at the 8% dip and protect your backside. The inertia behind this stock at the moment could easily launch this thing to 40 or 45.

Salve Lucrum

6 February 2011 Barron’s Review, The Week Ahead and a Pick

Last week the S & P 500 finished up again. A strong 2.71%. Let’s see what Barron’s has to say about the gain and how sustainable it might be. This weeks issue seems to be very positive while still noting the chance for a correction is very real. There was a little sidebar by Gene Epstein explaining away the lackluster jobs report on Friday. While the number improved, it was way off analysts expectations. The market took it in stride as most other economic data was good. All in all, we called most of the data points spot on last week. We suggested the jobs would be almost flat and they kinda were.

Barron’s had some nice things to say about IDCC InterDigital, Inc. engages in the design and development of digital wireless technologies for use in cellular and wireless IEEE 802 related products. IBD has it rated a 99 and we will be doing more homework on it this week. Once that is done it has the making of a pick of the day. They were also pimping Corning GLW which we mentioned here a few weeks ago. The reason they like it, is their new Monster Glass which is being adopted in all kids of products. IBD likes them as well giving them a 92 rating. What caught my eye was the huge institutional buying in the last week. DO YOUR HOMEWORK. We do not own ether stock, but have them on our watch list.

Leslie Norton did a great job of connecting the dots between Tunisia, Egypt and Asian countries and what to look out for. This was an interesting read. Santoli’s article “Ready For A Breather” paints a rosy picture while reminding us a correction is lurking. (Just watch your stops and keep an eye on the market direction.) One of my friends asked when they should shift their Mutual funds to cash based. Unfortunately, but right for them they have been in balanced funds (bonds-Equities) for the last year and half. So they have seen some of the gain of the market but not all of it. I suggested they start to move now. Just change 10-20 of they funds to cash-bonds type funds and wait until they see the change a comin. My guess is this correction (again 2-25%) will come right about the time the Fed stops QE II which is March-April May.

The rest of the magazine mostly dealt with Mutual Funds ZZZZZZZZZ. I take that back seeing what mutual funds are buy can be an interesting tell as to where to look for stocks on the way up.

The week ahead.

Here are the data points for this week. (Remember this is important as it is a good engine behind the direction of the overall market and as we have discussed, 75% of your stocks direction is determined by the direction of the market and or sector.)

On Monday we have the consumer credit report coming out. You care about this as it is an indicator as to if people are spending. Since the economic crisis has occurred three years ago we have seen consumer credit drop and personal savings increase to a level not seen since WW II. We are seeing personal savings drop a little and if we can tie it with an increase in personal credit tomorrow, we might see some nice pops in the retail sector. Unfortunately the experts have pegged the increase of outstanding balance way up up from 1.4 Billion the month before. They are expecting 2.0 Billion. If weather kept people from finding jobs, don’t ya think maybe it kept them from charging crap on their credit cards? We are guessing a slight disappointment to 1.8Billion.

Tuesday we will see a couple of retail reports, but it will get snowed out as well.

Wednesday we will see the Energy Information Agency tell us how much oil is in the supply line. I am guessing strong demand so look for an implied up and coming demand pressure which should push oil prices higher. Good for us holder of CVX and other oil cans.

Also on Wednesday look for a kinder and gentler House Budget Committee to play a little nicer with Bernanke at his appearance before the group. That should not garner much attention unless the committee tells him how much money he is printing and scares everyone.

On Thursday there is wild card to watch and that would be the reporting of the Bank of England economic policy announcement. (Martin and Neil if you are listening, correct me if I am getting this wrong.) The policy is to chase a 2% inflation figure which they have not hit yet, but it does not take Nostradamus to see raw material costs and agricultural cost increases eventually impacting the inflationary picture in the UK. The BOE could send everyone a tap on the breaks by increasing their interest rates.25%. That could make for an exciting day in the market.

Also on Thursday we will have initial jobless claims. We find nothing to argue the consensus of 412,000 jobless applications. That news won’t help to hurt the market.

So how will the market end next week. The S & P 500 closed at 1,310.87 on Friday. It will close at 1,329 next Friday.

Earlier in the week we told you we were working on a tracking mechanism that might help us get a gauge of market trends. It is the combination of some IBD information as well as some data from the NYSE. It is the averaging of the last 10 days of momentum.

Once we have a few more data points under our belt, we will apply some magical mystical standard deviations to the chart to determine some upper and lower control limits to spot anomalies. Until then we will publish the chart every week. We will be looking for a number below 6.0 to indicate a downward trend not only in the beautiful chart, but the overall market. Then again, we might be just wasting ours and your time. We will see.

Pick of the Day AGAIN

Let’s take a serious look at SWKS again. Megan brought this to us last week. Our suggestion was to wait for a few more positive days above 30 and we go them. Friday’s volume was 4.6 million shares and the stock was up 3%. This is a good entry point at 35. DO YOUR HOME WORK. WE WILL OWN THIS TOMORROW. We may be long or get in on a 2 month slightly out of the money call option. Put your stops in at $32.25. If Megan took our suggestion to stop at $25.50, you might want to scoot them up a bit to the 32.25 level. If you do not want to use the stop another idea would be to buy a put option just out of the money 3-4 months out. It will accomplish the same thing. If you are not experience in options, just sell the equity at the 8% dip and protect your backside. The inertia behind this stock at the moment could easily launch this thing to 40 or 45.

Salve Lucrum

0 Comments:

Post a Comment

<< Home