September 7, 2010 Let’s find something to worry about.

BAGAKOAA September 7, 2010 Let’s find something to worry about.

People came back from Holiday and to my surprise the market kicked off lower. Apparently some good journalistic reporting (hard to find now a days) discovered that the European Bank stress tests that made everyone feel so good about month ago did not include certain bonds and did not disclose many short positions so what was good now looks not so good. So the market headed down, lead by financials and gold was up.

We have been telling you that corporate America has more cash on its balance sheets than since WW II. Estimates are between 1.6-2 trillion dollars. So what does a company do with all that cash? We’ll they wait for the government to blink, and they may have this weekend. There is a “leak” (from Rahm Emanuel Whitehouse Chief of Staff) that the President will announce a 100% tax credit for companies that invest in equipment and plant improvements and this break will be retro to today.

Now without boring you to death and having the accountants in the audience sending me notes saying how I did not explain it correctly, if you make a capital investment in your company, you have the option of spreading that depreciable cost over a period of years, theoretically over the life of the asset purchased. President Obama will announce a tax credit that would allow companies who make a capital investments (think buildings, trucks, earth moving equipment, computer systems, etc) in the balance of 2010 through the end of 2011 to take a tax right off for the full amount in that tax year. In essence, If GM spends 500 million on a plant overhaul in Norcross Georgia, they might have to right that off over 20 years. This would mean a tax deduction via depreciation of 25 million a year. The idea being proposed would let GM take a depreciation expense of 500 million in 2011. That would equate to 175 million more money to spend on other stuff like jobs, benefits research and development (oh yeah this idea is being floated with another tax incentive of 50 Billion for research and development investments).

According to the Whitehouse, 1.5 million businesses would be eligible for participation in the tax credit. At face value, this proposal should have lifted the market immensely. Here is the problem. These are just ideas and while it maybe good. (There are those in the service sector who say it won’t help the service sector, which is debatable.) Because they are ideas, they still have to get through the very small window of the congressional calendar. Republicans will be blockhead obstructionists and Democrats will blame the republicans for not getting this passed. Ironically if you go back to the 2008 campaign, capital investment tax credits, R & D tax breaks and infrastructure spending we all put on the table, but not by the current administration. (actually there were R & D proposals for alternative energy and bio fuels, so there were some R & D proposals). Remember both parties have one goal in mind and it is not new jobs, it is not keeping spending in check, it is not economic sustainability, it is to get re-elected.

Since everyone knows that re-election is Job 1, the market is not taking these ideas as the immediate fix all it may appear to be on paper because it still has to get passed and that probably won’t happen with out some huge position shifts by republicans (and a few democrats). That will not happen without serious reconsideration of extending the Bush tax cuts.

Now getting back to the money. All of these companies have all of this cash so what are they doing. They are using their healthy balance sheets to borrow money. I know that does not seem to make much sense, but just look at some of the recent corporate bond activity. NSC, Norfolk Southern just reactivated a 100 year bond issuance and subscribed 250 million in new notes at 5.95%. They are taking advantage of the low interest rates and there are those out there seeing a long term 6% yields as very attractive. IBM, MCD, and JNJ all have had recent bond issues floated. Most are 10 year coupons at a 3% yield. That is cheap money. So they sit with billions on the balance sheet and get more cash because its cheap. This trend should continue well into the Q 1 2011.

If and when we ever get the final regulations for health care and finance and know what if any tax deductions remain, this economy is poised to grow quickly and maybe too quickly.

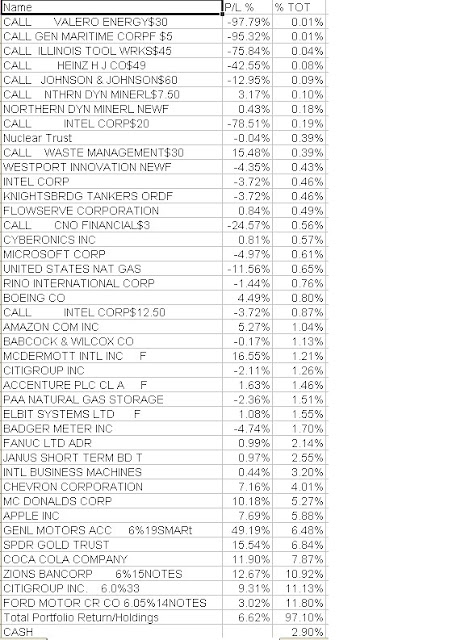

The Salve Lucrum Portfolio

It has been a while since we gave you a snapshot of the portfolio so now seems like a good time to do it. We are month away from the next earnings seasons (October 7th is Alcoa) so there is little action in the portfolio.

You’ll note there is about 40% in Bonds, 7% in Gold (Should be higher), under 3% in call options and the balance in long equities. We are doing our best to keep that 50% balanced in Finance, Energy (oil and gas). Aerospace/heavy industrials, technology and speculative. Each of those sectors have about 15%-20% in them to keep it balanced. If you have any questions, let me know.

From the Nixon Archives

"No Mr. President, right there in my Passport. My name is Davis not Jangles, I swear."

Salve Lucrum

0 Comments:

Post a Comment

<< Home